Brazil’s position as the largest economy in Latin America and a leader in regional integration through the Southern Common Market (Mercosur) continues to attract foreign investment and ambitious international companies. While the scale, urban dynamism, and significant private sector present a broad spectrum of business opportunities, the operational landscape in Brazil is complex. Executives must grapple with regulatory hurdles, an intricate tax system, regional market variations, and shifting economic and political dynamics. This article—from the perspective of a corporate risk management consultant—maps the main risks, analyses strategic scenarios, and provides actionable frameworks for expanding your company to Brazil with confidence.

Key Risk Identification in the Brazilian Market

Before entering the Brazilian market, executives must develop a comprehensive understanding of the local business environment. Brazil’s legal entity structures, regulatory bodies, complex tax system, and labor laws differ considerably from those found in the United States or other Western economies.

Brazil requires foreign investors to navigate through a multistep process for company formation, from choosing the appropriate legal entity—such as a Limited Liability Company (Ltda) or a corporation (S.A.)—to registering with multiple federal and state agencies. Due diligence is crucial. Failure to understand registration, labor, and tax obligations can delay operations and expose company leadership to regulatory penalties.

Additionally, financial risk is heightened by mandatory capital requirements, foreign exchange controls, differing business practices, and significant tax liabilities affecting corporate income. Due to regional disparities, conditions in Brazil fluctuate, impacting costs and risk exposure in cities like São Paulo and Rio de Janeiro. Scenario-based risk identification can help organizations prioritize resource allocation and prevent costly surprises.

Scenario Analysis: Economic and Political Landscapes

Brazil’s economy, while resilient, is marked by cycles of political volatility and macroeconomic shifts that can present obstacles for international companies. The interplay between federal, state, and municipal jurisdictions often complicates regulatory predictability and operating in Brazil. For example, government policies on labor or the tax systems may change in response to broader economic strategies or electoral cycles.

Risk managers should regularly evaluate the political climate and contingency scenarios. For instance, maintain close attention to indicators such as inflation, GDP growth, trade balance, and changes to the country’s business-friendly reforms. Engaging with local business associations and following resources like the Brazil Country Commercial Guide can provide timely insights and serve as an early warning system for executives planning their market entry.

Mitigation Strategies for Market Entry

Risk-aware organizations understand that mitigating market entry challenges requires more than knowledge. It requires action. Here, a structured risk management approach—drawing from international frameworks such as ISO 31000—enables executives to anticipate, respond to, and reduce adverse impacts.

A recommended step is to establish advisory relationships with local consultants well-versed in Brazilian market regulations and business practices. These professionals can help you clarify operational requirements, manage stakeholder relationships, and align hiring processes with compliance standards.

Countless international companies find success by implementing the following mitigation tactics:

- Conduct thorough regulatory and cultural due diligence before market entry.

- Select a legal entity structure that best matches medium- and long-term strategic goals.

- Build robust internal compliance and audit functions adapted to the Brazilian tax environment.

- Utilize scenario planning to prepare for shifts in regulatory or market conditions.

- Leverage local knowledge to foster resilience and foster long-term business continuity.

Adopting these measures is especially important in metropolitan markets like São Paulo, where competition, regulatory oversight, and business opportunities are most intense.

Navigating Regulatory and Tax Complexities

Operating in Brazil requires agility and forethought at every turn, particularly when engaging with the country’s layered regulations. The Brazilian tax regime is often cited as one of the most complex in the world, comprising more than 60 different tax types, including federal, state, and municipal levels. For companies unfamiliar with the landscape, the risk of non-compliance and ensuing penalties is a real threat.

Frameworks for risk mitigation should focus on continual monitoring of legislative changes and routine consultation with specialized counsel or tax advisors. Companies are advised to utilize digital tools and local expertise to manage tax filing systems unique to the Brazilian market. A recurring best practice is setting up an internal compliance dashboard tailored to monitor the company’s tax, labor, and regulatory status throughout the year.

One actionable resource is the starting a business in brazil guide, which provides a step-by-step synopsis of forming a business, which is particularly beneficial for executive teams unfamiliar with regional bureaucracy.

Looking forward, aligning company interests with macroeconomic trends and evolving business practices is critical to thrive and capitalize on Brazil’s immense marketplace.

Operational Considerations in Major Cities

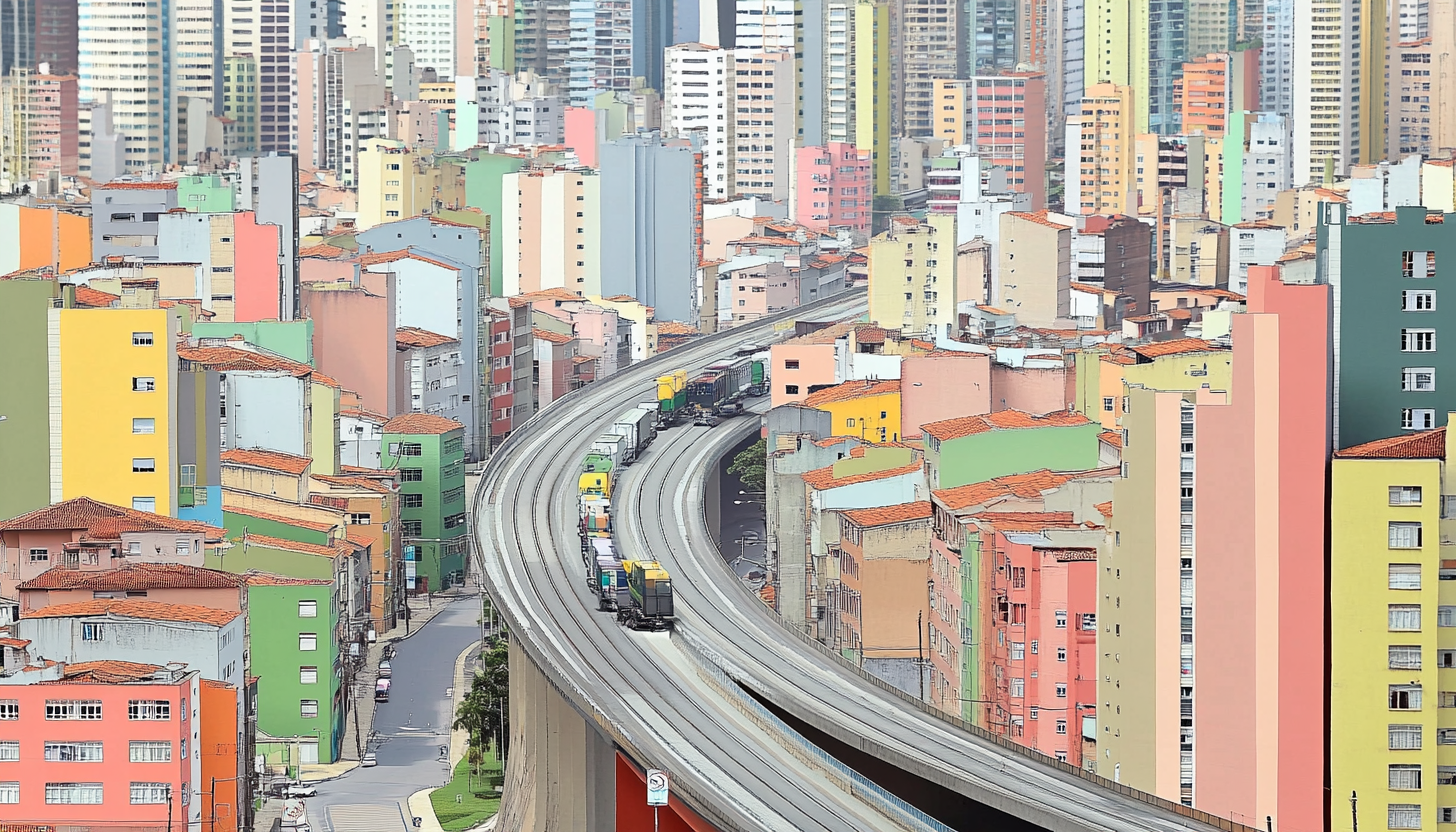

Success in Brazil often comes down to understanding operational dynamics in its most influential urban hubs, with São Paulo and Rio de Janeiro leading as economic engines. Each city presents distinct conditions in Brazil, with São Paulo acting as the gateway for finance, industry, and multinational headquarters, while Rio de Janeiro commands importance in energy, logistics, and creative sectors.

Selecting the right operational location must take into account not only tax and regulatory differences but also infrastructure quality, human resource availability, and long-term business growth projections. For example, São Paulo boasts advanced transport, logistics, and telecommunication infrastructure, making it an attractive base for regional operations.

Strategic Recommendations for International Companies

As international companies consider expanding into Brazil, it is imperative that executives adopt a proactive and informed approach to risk management. This involves continuously assessing the market’s fluid environment, recognizing that both São Paulo and Rio de Janeiro serve as benchmarks for the rest of Latin America in terms of innovation, corporate income structuring, and private sector leadership. Learning from regional best practices, companies benefit immensely from local advisory networks and participatory industry groups that provide timely updates on legislation, business environment shifts, and evolving market expectations.

One particularly effective strategy is to cultivate strong relationships with Brazilian legal and tax advisors who have a proven track record of guiding foreign investment. This allows for swift adaptation to emerging regulations, thus safeguarding compliance and corporate reputation. Furthermore, companies are encouraged to participate in local trade associations or foreign chambers of commerce, which serve as both advocacy platforms and insider guideposts to business opportunities.

Utilizing scenario planning continues to be a crucial method for anticipating disruption within Brazil’s complex regulatory and political context. Mapping potential government policy changes, currency fluctuation impacts, and shifts in consumer behavior allows risk managers to create robust contingency plans. Executives should likewise develop cross-functional teams—combining legal, financial, and operational expertise—to monitor and execute business strategy in real time, thereby building resilience in a fast-moving Brazilian market.

The adoption of digital transformation can also play a decisive role in managing complexity. Custom internal dashboards and risk analytics tools permit measureable oversight on compliance, tax filings, and labor relations. Given the prevalence of sudden changes in Brazil’s business landscape, having instant visibility into risk areas significantly improves decision-making and facilitates prompt responses.

Framework for a Successful Market Entry

Expanding into Brazil demands a balanced approach: leveraging the market’s strengths while mitigating unique entry barriers. The following framework encapsulates actionable steps for international executives:

- Localize Entry Strategy: Adapt your strategy to align with the nuances of the Brazilian market, customizing product offerings, pricing, and marketing approaches for local tastes and consumer behavior.

- Strengthen Corporate Governance: Implement transparent governance structures that foster local compliance and uphold the standards set by your company’s head office, especially when managing subsidiaries in Brazil.

- Establish Long-Term Partnerships: Forge durable relationships with local suppliers, distributors, and professional advisors to support operational resilience and sustainable growth.

- Prioritize Talent Acquisition: Tap into Brazil’s diverse talent pool—especially in major cities—and implement robust human resources practices for attracting top talent, managing labor costs, and ensuring compliance with local regulations.

- Embrace Technology: Deploy digital solutions that streamline regulatory compliance, optimize supply chains, and foster real-time performance monitoring throughout your Brazilian operations.

Each step should be tailored to local realities, especially given the variations between São Paulo, Rio de Janeiro, and other commercial centers. Executives should also consider engaging in regular benchmarking with peers operating in Brazil to ensure continuous improvement of internal processes and strategy.

Final Strategic Takeaways

Success in Brazil is predicated upon a well-informed, risk-focused strategy that accounts for both the opportunities and complexities inherent to Latin America’s largest economy. The country’s business environment is shaped by dynamic regulatory conditions, changing political climates, and regional disparities between major urban centers and other areas.

International companies must prioritize due diligence, cultural understanding, and strategic partnerships. Ongoing engagement with up-to-date resources—such as the Brazil Country Commercial Guide—further provides critical risk intelligence. Notably, leveraging the starting a business in brazil resource simplifies the process of understanding the legal entity landscape and corporate income taxation rules.

While conditions in Brazil can be challenging, they are far from insurmountable. Savvy executives who invest in scenario planning, compliance analytics, and strong local advisory relationships consistently outperform those who view expansion as a standard market entry exercise. Brazilian market data suggests that multinational firms with adaptive, risk-informed frameworks achieve sustained growth and capitalize on new business opportunities as they emerge.

As the southern common market continues to harmonize policies and increase cross-border potential, companies already established in Brazil will enjoy increased influence across the entire Latin American region. Being strategic, prepared, and locally attuned is not just a competitive advantage—it is a necessity for lasting success in Brazil.

For executives exploring Brazil as a launchpad for Latin American growth, focusing on regulatory preparedness and stakeholder engagement is critical. Not only does this support streamlined entry and operations, but it also builds resilient foundations for weathering political changes, shifts in the complex tax system, and the inevitable evolution of the business environment.

In conclusion, expanding business to Brazil requires diligence, adaptability, and a robust risk management strategy. By applying best-practice frameworks, engaging experienced local advisors, and leveraging sector-specific intelligence, your organization can thrive in one of the world’s most dynamic markets.